Pension premium calculation in the Netherlands

You’re looking to expand overseas because business is booming. You start to get a lot of orders and then you take on your first Dutch employees. Before you do, there are some things you need to know about the Dutch pension system, like how the premiums are calculated.

PensioenVizier provides clear advice and insight into the costs and benefits, and all agreements are recorded in a convenient booklet, enabling us to easily access and review our pension and financial planning information and agreements at any time.

Majority of pensions in the Netherlands

In the Netherlands pension is 80% ruled by unions. This means there is no other choice then to comply and join a pension union. If your company compulsory belongs to a union ruled pension, there is no choice at all. There are no strict rules whether you belong to a certain pension fund. If you don’t know whether or not you need to join a pension union? Please contact us and we will help you out! The 80% of pension is the working population which pay about 20-25% over the pensionable wage. We’ll explain the calculation in a moment.

Minority of pensions in the Netherlands

The remaining 20% of pensions is the so called “free zone”. This literary means that everything is possible. From no pension at all to a very good pension (with a very high premium). In general, most companies in the “free zone” choose for 10-15% of the pensionable wage.

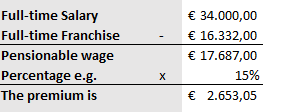

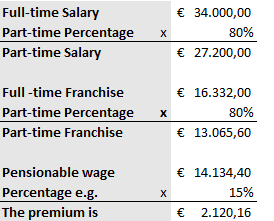

The calculation.

There are two different calculations for full-time and part-time

Full-time employees

Part-time employees

Dividing premiums.

In the “free zone” there is also the possibility to divide the premiums. In this way, your company doesn’t take 100% of the premiums but divides it in for instance 70% for the employer and 30% for the employee.

All costs of a pension scheme.

The pension premium is not the only cost to take into account. You also need to make sure you know what the other costs are, for instance;

– The risk premium spouse and orphan survivor’s pension

– The risk premium waiver in the event of incapacity for work or disability

– Costs of the insurer

– Advisory cost

If you want to have one complete overview of all the costs, please visit our calculation tool. Here you will find (in Dutch) all the cost in five categories; Iron, Bronze, Silver, Gold and Platinum, which represent the decency of your pension scheme.